who pays sales tax when selling a car privately in michigan

Although not legally required in Michigan a Bill of Sale should include the following information. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

What Transactions Are Subject To The Michigan Use Tax Kershaw Vititoe Jedinak Plc

You can avoid paying sales tax on a used car by meeting the exemption circumstances which include.

. Notice of New Sales Tax Requirements for Out-of-State Sellers. Answer 1 of 9. Michigan requires a 6 use tax be paid by the seller on all private vehicle sales unless you are transferring the title to someone with a tax exempt status.

For example theres a state sales tax on the. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. These fees are separate from the sales tax and will likely be collected by the Michigan Department of Motor Vehicles and not the Michigan Department of Treasury.

According to the Sales Tax Handbook because vehicle purchases are prominent in Illinois they may come with substantial taxes. The buyer will pay sales tax on the purchase price. What transactions are generally subject to sales tax in Michigan.

Thats why the fact that the sales tax will go on the federal governments website next month is the most important thing happening in Washington right now. In some states used car sales are sales tax free theory that sales tax collected when sold new not double taxing in. That depends on the sate and the laws regarding sales tax.

For transactions occurring on and after October 1 2015 an out-of-state seller may be. After all a title transfer comes with fees and. In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a.

If this seems high the good news is there is no other sales tax applied to car purchases at the. For example lets say that you want to purchase a new car for 30000 you would use. Streamlined Sales and Use Tax Project.

Selling a Junk Car in. When the excitement winds down you and your giftee will need to sit down and determine the logistical details of the car. Year Make and Model of the Vehicle.

Selling a vehicle for a profit is considered a capital gain by the IRS so it does need to be reported on your tax return. If a vehicle is purchased from an Indiana dealership the dealer will collect the sales tax and provide proof of the sales tax paid on an ST108 Certificate of Gross Retail or Use Tax Paid. A recent study by.

You will register the vehicle in a state with no sales tax because. It depends on the length of the permit. Title transfers must take place within 30 days from the date of sale otherwise a late penalty fee will be charged.

And permits valid 60 days cost 20 of the annual. On any car purchase in Michigan you will need to pay a 6 sales tax. If you are buying or selling a car for the first time you may be unaware of how taxes are paid for this type of transaction.

Buying a car or any other motor vehicle is a taxable transaction. If you spend 7000 on a car and an additional 1000 on. You can calculate the sales tax in Michigan by multiplying the final purchase price by 06.

But permits valid 30 days cost 10 of the annual registration fee or 20 whichever is higher.

Michigan Sales Tax Small Business Guide Truic

7 Steps How To Get A Michigan Car Dealer License Surety Solutions A Gallagher Company

Free Bill Of Sale Forms 24 Word Pdf Eforms

Michigan Vehicle Registration And Title Information Vincheck Info

Michigan Laws About Private Used Car Sales

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

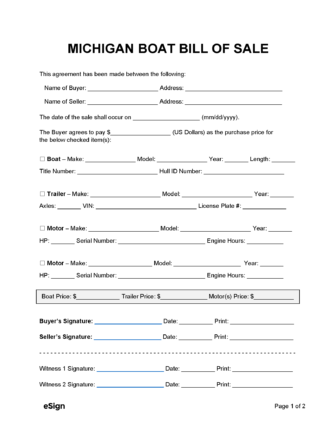

Free Michigan Boat Bill Of Sale Form Pdf Word

13 Printable Vehicle Purchase Agreement With Monthly Payments Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

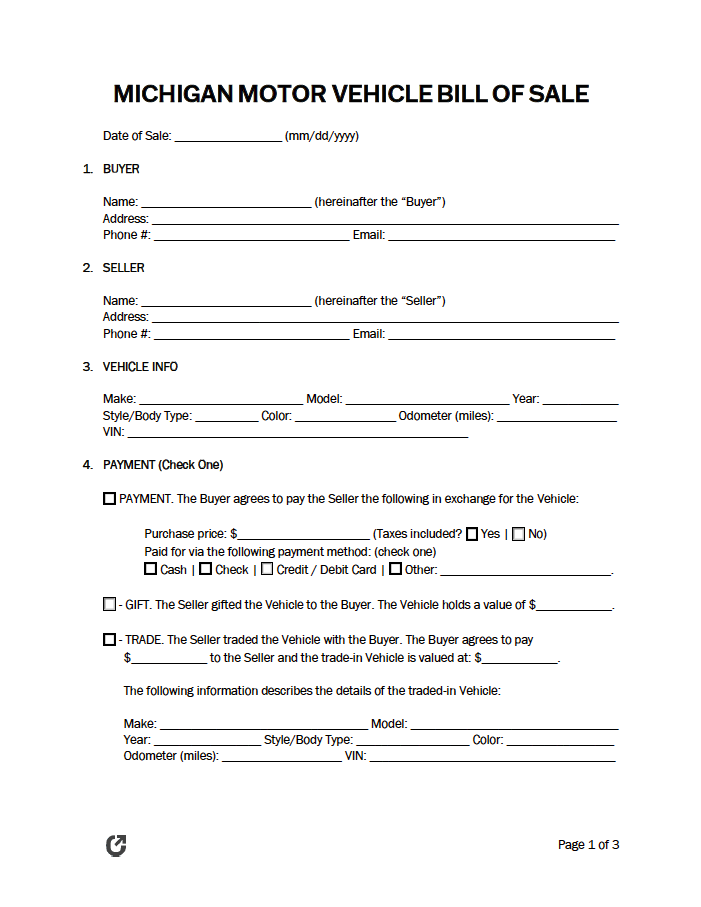

Free Michigan Motor Vehicle Bill Of Sale Pdf Word Eforms

Michigan Bill Of Sale Forms Information You Need To Create A Bill Of Sale

What Do I Do With My Plates After I Sell My Car Sell My Car In Chicago

8 Tips For Buying A Car Out Of State Carfax

Free Michigan Motor Vehicle Bill Of Sale Form Pdf Word Rtf

Bill Of Sale Form Michigan Motor Vehicle Bill Of Sale Templates Fillable Printable Samples For Pdf Word Pdffiller

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)